Animal Production, Consumer Demands and the Role of the Feed Industry in Japan

Dietary life of the Japanese people has changed enormously over the past 50 post-war years. The protein/fat/carbohydrate (PFC) calorie supply ratio in Japan, as of 1995, is 13.6:29.5:56.9 (FNRA, 1997). This is a rather desirable figure compared to those of Western countries.

The average life expectancy in Japan is 76.4 years for men and 82.8 years for women (MHW, 1995), which makes Japan the nation with the longest life expectancy in the world. The Japanese have also improved in terms of physique during these years. During the 20 years between 1975 and 1994, average weight of males and females at 20 years of age has improved 7.2 and 4.2%, respectively; and height 2.0 and 1.8%, respectively (MHW, 1994).

Such beneficial changes may be attributed largely to the animal production industry, which played an important role by supplying high quality protein to consumers whose purchasing power strengthened through Japan’s economic growth. The animal production industry could not have thrived without the development of the feed industry.

However, ever since the GATT/Uruguay round of trade agreements of 1993, the Japanese animal production and feed industries have faced the great challenge of increased import of animal products. Greater import means domestic livestock and feed industries may be endangered by a potentially smaller market. Domestic animal producers must face and survive tough competition not only with imported products, but also among themselves.

Meanwhile, meeting consumer demands is also a great challenge for the industry. Japanese consumers are no longer satisfied with ‘average’ animal products. They tend to desire somewhat ‘distinct’ products. Distinct in this context refers to healthfulness, safety, freshness, organic (no pesticides), taste, meat color, etc. Thus, developing ‘distinct’ animal products has become one of the most important survival strategies in the industry.

Consumption trends and import ratios of animal products

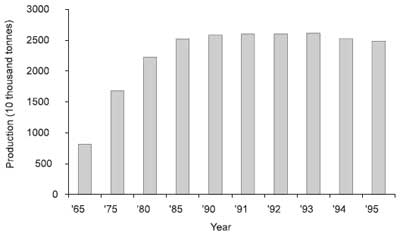

Animal production in Japan has continued to grow since the 1960s and roughly reached peak in the mid 1980s. Corresponding to this, formula feed production has grown in roughly the same manner (Figure 1). Diet and life styles ‘westernized’ during this period, especially among the younger generation.

In terms of animal food products, consumption of meat has increased sharply compared to that of aquatic products. Daily protein supply per capita was 10.3 g of animal product and 15.5 g of aquatic product in 1965; but has changed to 28.9 g of animal product and 19.5 g of aquatic product in 1995 (MAFF, 1995). Relative to this, meat imports have increased. In 1975, imported meat (beef, pork and chicken) made up 11.0% of the total demand for these three meat types. As of 1995, imported meat makes up 42.9% (MAFF, 1995; MOF, 1965–1995). This means that imports have increased by nearly a factor of four in 20 years.

Figure 1. Formula feed trends (MAFF,1995).

TRENDS FOR INDIVIDUAL ANIMAL PRODUCTS

Trends of domestic beef production and beef import are shown in Figure 2. Annual per capita beef consumption is about 7 kg. This is roughly five times greater compared to the 1960s. As of 1995, 61.1% of the total amount of beef consumed was imported. Pork is the most popular meat product in Japan with per capita consumption about 12 kg. Trends of domestic production and import are shown in Figure 3. As of 1995, 41.0% of pork was imported.

Consumption of chicken meat is highest after pork and annual consumption is about 10 kg per capita. As of 1995, 30.1% were imported. Trends of chicken meat production and import are shown in Figure 4.

Figure 2. Trends of domestic production, import and per capita consumption of beef (converted to dressed carcass: 70% for beef, internal organs and tongue excluded) (MAFF, 1995; MOF, 1965–1995).

Figure 3. Trends of domestic production, import and per capita consumption of pork (converted to dressed carcass: 70% for pork, internal organs and tongue excluded) (MAFF, 1995; MOF, 1965–1995).

Among different meat types, beef consumption has increased exceptionally relative to increased meat import. However, domestic production has shown no remarkable fluctuation. Meanwhile, pork and chicken consumption seems to have stopped growing and domestic production has gone down slightly.

Figure 4. Trends of domestic production, import and per capita consumption of chicken meat (MAFF, 1995; MOF, 1965–1995).

Japan currently produces about 2.5 million tonnes of eggs. This makes our country the fourth largest egg producer in the world. Most of demand is met by domestic production. As of 1995, import provided only 4.1% of eggs consumed, with most of it being liquid egg and hardly any shelled eggs. Annual consumption per capita was 278 eggs in 1970 and 345 eggs in 1995 (ALIC, 1997). Japanese egg consumption is one of the highest in the world.

Consumption of milk and dairy products has been growing steadily since the 1960s, but reached a peak around 1990 and has remained at that level since. The total amount of consumption, as of 1995, is approximately 11 million tonnes in terms of raw milk. Eighty percent of this, 8.5 million tonnes of raw milk, is produced domestically. Sixty percent of this domestic production is for drinking and the remaining 40% is used for processing (FIRA, 1996).

The feed industry’s effort to produce ‘distinct’ animal products

Many distinctly characterized animal products branded according to different places of production, names of farms, names of breeds, available nutrients, etc. are now marketed in Japan. As shown in Figure 5, the numbers of brand names have markedly increased in recent years. As of 1994, pork and beef have the greatest variety of brand names, each having 150 different brands.

There are 80 brands of chicken meat and 69 brands of eggs. In comparison with the numbers from 1988, pork brands increased 2.2 times, eggs by 1.9 times and beef and chicken meat by 1.6 times. Similar efforts can be seen with milk and dairy; which emphasizes that characteristics such as freshness, safety, and healthfulness are being developed. However, such efforts are more a role of the milk industry than the feed industry and therefore we will not go into this aspect any further here.

One of the most important means of developing new brands is the use of non-conventional or extraordinary breeds of stock to achieve distinct characteristics such as higher meat quality.As an example,Wagyu (Japanese Cattle), especially Japanese Black Cattle meat may be clearly differentiated from Holstein steer meat or imported meat.

Among Wagyu, some brand names, such as Matsuzaka Cattle, have been successful in attaining high credit due to their extremely high meat quality. In pigs, the Berkshire type black pigs are highly credited in terms of meat quality. Further, new strains have been developed in attempts to produce meat distinct in terms of quality, color, backfat thickness, etc., in various regions around the country. In meat type chicken, local breeds and red broilers are utilized. Concerning eggs, since the majority come from White Leghorns, differentiation is possible by using Brown Leghorns.

Additionally, feed is another important factor used to differentiate animal products. Using feedstuffs ‘desirable’ to the consumer and eliminating ‘undesirable’ ingredients, or adding components that have health-promoting effects to the feed are some possibilities. Such changes are intended to produce distinct products in terms of improved meat quality and(or) certain available nutrients transferred into the product from the feed.

Figure 5. Numbers of meat and egg brand names (Central Association of Livestock Industry Survey, 1995).

It is not unusual to combine both breed and feed factors in the attempt to produce distinct products. Feed producers today not only supply specific feed that can help production of distinct animal products, but also provide certain feeder stock and feeding management techniques to the animal producer.

Further, some feed producers place their own animal products on the market as part of an effort to establish certain brands.

In the following, we will review some efforts seen to produce distinctly characterized animal products for each animal type, mainly from the feed industry’s point of view.

BEEF

The Japanese have quite a unique taste for beef. Some of the most popular beef dishes are sukiyaki, barbecued beef, beef steak and shabu-shabu. In terms of meat quality, we prefer beef that is soft and even beautiful in appearance when made into slices.

According to the Japanese beef carcass grading standards, meat quality is graded by four indices: (1) color and complexion, (2) firmness and texture, (3) fat inlay (marbling) and (4) color and quality of fat. Fat inlay is especially important; and meat of high fat inlay (marbled meat) sells at very high prices. Wagyu production usually aims to produce meat distinct in terms of fat inlay. Today,Wagyu makes up approximately 42% of the adult beef cattle shipment (in number of animals) (MAFF, 1997) and approximately 40% ofWagyu carcasses are differentiated under brand names.

Traditionally, Wagyu cattle have been reared in small numbers and fed with on-farm feed mixes. Animals are fed in a traditional way using a unique feed consisting mainly of barley and wheat bran. In recent years, some farms have begun to rear Wagyu on a large scale. As a consequence, feed manufacturers have come to sell Wagyu-specific rations on the market.

Most of these commercial feeds mainly use barley and wheat bran because of the effect seen on meat firmness and fat hardness and color. Wagyu cattle are usually fattened for up to 30 months or even through more than 36 months of age.

Careful attention must be paid to energy and fiber levels in the feed in order to achieve optimal growth rates and avoid metabolic disorders such as acidosis and urolithiasis. The finding that high vitamin A levels in the feed can discourage fat inlay while low levels in the feed (leading to low vitamin A retention in the body) can encourage fat inlay is one of the topics of today. Further, high blood vitamin A levels have been found to lead to darker meat color.

Dark color meat is not welcomed by the retailer and therefore the price of such carcasses tends to be lower.

Meanwhile for Holstein steers, which make up 29% of the adult cattle shipped, there are two directions for fattening. One method aims at faster growth while the other puts more emphasis on meat quality. It is necessary to design feeds that suit the above objectives. Recently, more emphasis is put on meat quality by rearing F1 cross calves obtained through artificial insemination of Wagyu bull semen to Holstein cows instead of rearing Holstein steers.

PORK

Distinctly characterized pork produced by Berkshire crossbreeds is superior in terms of meat quality and taste. It is estimated that this pork comprises several percent of the total pork market. Production started in the southern Kyushu area when producers began feeding sweet potatoes, a local specialty, to Berkshire pigs. Thus, feed for black pigs produced by formula feed producers initially included sweet potatoes. However, today alternatives such as tapioca and barley are used. This results in better taste as well as better fat color and hardness.

Today, five manufacturers and organizations that produce and market formula feed own specific pathogen free (SPF) grandparent pig farms and supply parent pigs. SPF pigs are reared in very healthy conditions under low levels of disease exposure. Sensory evaluation tests have confirmed significant superiority of SPF pork in terms of meat softness and taste. Further, SPF pork is accepted by consumers for reasons including lighter meat color, and the fact that carcasses are free of drug residue because drugs to cope with disease are not used, etc. SPF pork now forms over 10% of the total pork production.

Other distinct brands of pork include one with higher vitamin E content (2 to 3 times more than ordinary pork) and beneficial a-linolenic acid content brought about by using special feedstuffs such as perilla and vitamin fortification.

In addition, animal origin ingredients may be totally excluded from the feed in order to enhance taste while reducing smell. These products are sometimes branded as ‘natural, healthy, and delicious’ pork. Another marketed brand of distinctly characterized pork adds pyrolignous acid to the feed in an attempt to achieve firm meat, less drip loss and low fat.

CHICKEN

Breeds other than the meat chicken breeds developed in Europe and America are used to produce distinctly characterized chicken meat. These breeds include native breeds of Japanese Game, Nagoya, Rhode Island Red, Barred Plymouth Rock and New Hampshire strains. Game chicken is said to have come from China more than 300 years ago; and the other strains also have been reared for a long time in various areas of Japan.

In practice, native breeds are used as either parent of feeder chicks. In some other cases, red broilers are used. In any case, these birds will have low fat and can be clearly differentiated from ordinary broilers in terms of meat quality. These birds require more days to market; thus feed manufacturers have adjusted feed designs to correspond.

Another differentiation effort made using dietary means is, like pork, the addition of certain components such as a-linolenic acid, vitamin E and pyrolignous acid.

Recently (June, 1997), a survey on how consumers recognize these distinctly characterized products was carried out. Results are shown in Tables 1 and 2.

Of the 2,000 households surveyed, 49.9% had purchased some kind of a distinct brand chicken. Looking at different age groups (based on age of the person in charge of housework), older age groups showed higher rates of purchasing branded chicken.

The highest purchase rate was 54%, seen in the 40–59 year age group. Regarding the relative amount of branded chicken purchased, 22.9% of the subjects replied that more than 90% of the total chicken purchased was branded chicken and 31.0% replied that the rate was 50 to 90%. In evaluating distinctly branded chicken, of the 998 subject households, 60.2% said it ‘tastes better’ while 38.0% said it was ‘good for your health’.

Here we can see the two major factors that determine the consumer’s purchasing behavior.

Table 1. Purchase rate of distinctly branded chicken meat.*

*Source: Consumer sruvey of seasonal meat consumption trends, Japan Meat Information Service.

†Age of person in charge of housework.

Table 2. Evaluation (%) of distinctly branded chicken meat.*

*Source: Consumer sruvey of seasonal meat consumption trends, Japan Meat Information Service.

EGGS

Many formula feed producers now act as integrators in the industry by producing distinct brands of eggs on their own farms or on consignment and selling them to consumers. In other cases, large scale egg producing firms sell their brand of eggs on a nationwide basis while smaller firms sell theirs locally. Methods of differentiation in the marketplace are distinct combinations of breed, feed, rearing methods, etc., similar to other animal products.

Brown Leghorn breeds developed by European and American breeding firms are more popular than White Leghorn breeds for the production of distinctly characterized eggs. While white eggs are mainstream in our country, red eggs are generally welcomed by consumers and seem to remind people of the days when birds were reared in open yards in front of houses. Currently, more than 30% of breeding hens are brown layers.

Feed is the most important factor in differentiating eggs. Certain available components, such as vitamins A, D, E, B1 and B2, a-linolenic acid, DHA and minerals including iodine and iron, are added to the feed, or nonconventional feedstuffs are used in order to enhance transfer of certain components to the egg.

Among these, the iodine-enriched ‘Iodine Egg’ has the largest share in sales volume and is probably the pioneer of distinctly characterized eggs as well as being one of the most successful of all distinctly characterized animal products. Figure 6 shows annual sales trends of Iodine Eggs. Many research reports have referred to the beneficial effects of Iodine Eggs including lipid metabolism enhancement, blood cholesterol reduction and anti-allergenic effects. The Japanese customarily eat eggs raw; and many demand, eggs produced using only vegetable origin feedstuffs and no animal origin feedstuffs are also available on the market.

Figure 6. Sales trends of iodine-enriched eggs ‘Hikari’ (Foods Department, Nihon Nosan Kogyo).

Free range rearing is another method of differentiation. Brown Leghorns are usually used for this and the ‘natural’ image is emphasized. Such operations are undertaken on a relatively small scale on layer farms in various parts of the country.

During January through March of 1997 the Japan Poultry Association surveyed consumers on their perception of chicken eggs. The survey involved 3359 people who were asked to fill out a questionnaire. Eighty percent of these people answered that they ‘like eggs very much’ or ‘like eggs considerably’; so you can see that the Japanese are egg lovers (Figure 7). These people like eggs mainly because eggs ‘taste good’, ‘are nutritious’ and ‘are easy to cook’. Not as many as expected answered ‘because eggs are inexpensive’.

This implies that consumers would be happy to buy distinctly characterized eggs even if such eggs were somewhat expensive (Figure 8). Some of the reasons given for disliking eggs were:‘high cholesterol content’, ‘peculiar smell’, ‘allergy to eggs’ and ‘concern for drug and antibiotic residue’ (Figure 9).

Increasing cases of illness due to contamination of eggs by Salmonella enteritidis have become a serious problem in our country, too. To cope with this, the Hazard Analysis Critical Control Point (HACCP) system has been introduced to farms and grading and packing centers on a trial basis. This is one attempt to develop eggs emphasizing safety.

Conclusion

It is an important role of the Japanese food animal production industry to keep supplying animal products of low price and good quality to the market.

In that sense, the Japanese animal production and feed industries will continue to make efforts to maintain their competitiveness against imported animal products.

However, in this age of market globalization and increasing international trade, it is certain that domestic products can no longer dominate the market. The market will be shared between domestic and imported products.

So far, imported animal products have found their way into the professional food business, restaurants, prepared delicacies, etc., while domestic products have the major share of distinctly characterized products for general households.

Certainly domestic production has been suppressed by increased imports.

However, despite the increase in imports, domestic production of animal products and formula feed has not declined as much as expected. This implies that imported products have helped to push up overall animal product consumption in Japan.

Today, Japanese people dine out more often. This suggests that imported animal products intended for professional/restaurant uses may be able to further expand their market share in the future.

Meanwhile, concerning general household consumption, there seems to be a potentially greater requirement for distinctly characterized animal products especially among those households that are not regular purchasers of such products currently.

Whether the domestic industry can supply products at reasonable prices to meet this demand will have a serious effect on the future of the Japanese animal production and feed industries.

Figure 7. Likes and dislikes of eggs (Consumer Questionnaire Survey Report, Japan Poultry Association).

Figure 8. Different reasons for ‘liking’ eggs (Consumer Questionnaire Survey Report, Japan Poultry Association).

Figure 9. Different reasons for disliking eggs (Consumer Questionnaire Survey Report, Japan Poultry Association).

by Toshiaki Suzuki and Yohko Kashima - Research Center, Nihon Nosan Kogyo K.K., Tsukuba, Japan

This article hasn't been commented yet.

Write a comment

* = required field